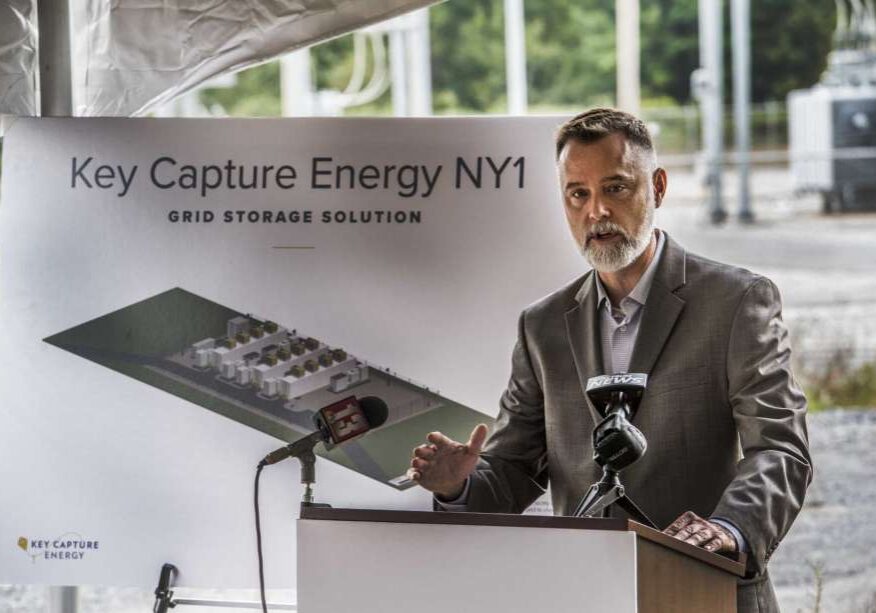

Energy Storage Tax Credit Will Boost Green Economy

Our COO, Dan Fitzgerald, recently submitted an Op-Ed to the Albany Times Union in which he opined that a federal energy storage tax credit will enable individual states to meet their ambitious clean energy targets. Currently, energy storage is eligible for the federal investment tax credit only when paired with a solar project. The Energy Storage Tax Incentive and Deployment Act, a piece of legislation that has bipartisan support in both houses of Congress, expands the federal investment tax credit to cover stand-alone storage projects.

Related Posts

Connecticut Strengthens Commitment to Fight Climate Change

The northeastern states that Key Capture Energy is developing projects in continue to strengthen their commitment to a clean energy…

Energy Storage Mandates Continue to Develop

On May 23, New Jersey became the fifth state in the nation to set an energy storage mandate. Governor Murphy…

New York State Releases Road Map to Guide Energy Storage into the Future

The New York State Energy Research and Development Authority (NYSERDA) unveiled its plan to achieve a nation-leading target of 1,500…